We help first home buyers get into the

property market easily.

Even if you may have been rejected by banks in the past.

We’ll help you get into the property market, even if you might not have the entire deposit easily accessible or might have been knocked back by banks in the past.

Our team of finance consultants, property specialists as well as external mortgage brokers and legal specialists make the process straight forward, easy and painless.

At Easy Wealth Homes: “No Deposit, No Worries”

Deposit: $15,000

Easy Wealth Is Ideal For You If……..

2. Have a permanent part time OR full time job and you are earning at least $45,000 year before taxes.

(Remember that even if you are not earning $45,000 a year on your own you may have partner, family member or friend who can be part of the loan with you)

Why You Should Buy A House From Easy Wealth Homes?

We help new home buyers who are wanting get into the property market. If you’ve been rejected by a bank in the past, we might be able to help you with a deposit and organise you a bank loan.

We will assess if Easy Wealth Homes could help by referring you to a finance broker who may arrange a Personal Loan for you. The interest rate for this loan will be fixed. This means you’re able to get your home and get started building long-term wealth through property. You become the legal owner of the property from day one and get the title of the house.

We work with over 42 lenders within

Australia including …

Did you

know

Even if you could buy a house on your own without Easy Wealth, buying a house through Easy Wealth is often cheaper than buying a house in a normal way, because you don’t need to borrow so much money from the bank and you can save thousands of dollars in Lender Mortgage Insurance (LMI).

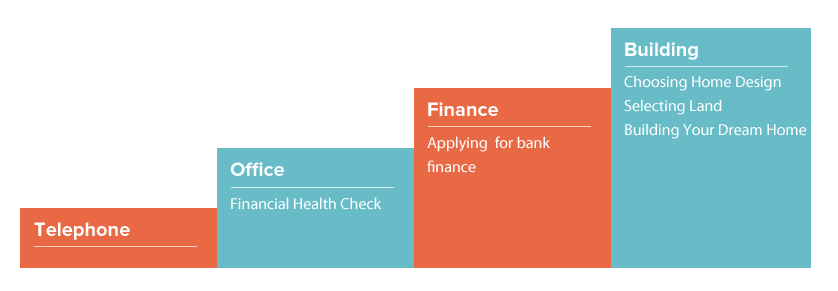

How The Easy Wealth Process Works

How The Easy Wealth Process Works

1 If you meet the criteria above make an

appointment with one of our friendly consultants

2

You’ll spend 1.5 hours with an accredited Mortgage

broker, property consultant and a legal

specialist.

3 The finance consultant will review your financial

position and organize a home loan from a bank that

suits your needs.

4 Our property consultant will guide you on the journey

of building your dream home – picking the block and

choosing the right size house.

the conveyancing.

6 At the end of your appointment you will be

on your way to build your dream home

Did you

know

Even if you could buy a house on your own without Easy Wealth, buying a house through Easy Wealth is often cheaper than buying a house in a normal way, because you don’t need to borrow so much money from the bank and you can save thousands of dollars in Lender Mortgage Insurance (LMI).

Apply For A 1.5 Hour

Consultation Session

With A Finance Consultant, Property

Consultant And Legal Specialist

Discover how you can get into the property market easily with a minimal deposit.

- Spend 1.5 hours with a finance consultant, property consultant and legal specialist (valued at $1500)

- We’ll give you solutions and a mortgage broker will arrange bank finance for you (even if you’ve been rejected in the past)

- We’ll help you on the journey of selecting the right home – choosing the block and picking the right size house.

- Friendly, straight forward and professional.

![]() We take your privacy very seriously

We take your privacy very seriously

Frequently Asked Questions About The 1.5 Hour In-Person Consultation

If your credit rating is in default, you may unfortunately not be able to get approved for a homeloan. However your partner/family may be eligible.

do? Do I have to bring a lot of

things to this meeting?

We attempt to make this

process as simple as possible.

You’ll need to bring along recent pay slips and proof of identification to the meeting … and then we’ll take care of the rest.

get?

We’ll help you select a house

that suits your needs perfectly.

We have got external accredited

finance consultants and licensed

by ASIC. Everything we do is

closely guided and regulated

by ASIC and all our houses are

independently valued by the

bank … so you know you’re not

paying too much.